What is the average credit card debt UK?

In this article, we'll look at:

Credit cards are an extremely popular form of borrowing, offering easy financing for everything from day-to-day purchases to one-off expenses. But as the convenience of credit cards becomes increasingly integrated into our daily lives, so does the potential for accruing debt.

Millions of people owe money to credit card providers, and for some, managing this debt can be overwhelming. Read on to discover the average credit card debt (UK) and explore some potential solutions, including Debt Management Plans (DMPs).

Credit card usage in the UK: an overview

Credit cards, a type of consumer credit, have become an integral part of the financial landscape in the UK. Consumer credit provides the flexibility to make purchases and pay for them over time with interest. Using a credit card can often have added benefits and perks. Some of the most common reasons for using a credit card include:

- Emergencies: For unexpected expenses that can't wait until payday, such as home and car repairs.

- Online shopping: Offering a secure and convenient way to shop online, with more security on purchases compared to using a debit card.

- Travel: From booking flights to paying for accommodations, credit cards are often required as a form of identification and security.

- Rewards and cashback: Many opt for credit cards that offer rewards or cashback on purchases, making everyday spending more rewarding.

- Building credit: Responsibly using a credit card, can help in building or repairing one's credit score.

The allure of credit cards is evident in their widespread adoption. There are around 60 million credit cards in circulation across the country, and over two-thirds of UK adults have at least one.

Unfortunately, though, using a credit card comes with certain risks. If you fail to repay the credit card balance in full each month, interest is added, often at a high rate. This can lead to a debt spiral, where balances continue to grow, and it becomes increasingly hard to cover your minimum payments and manage your credit card debt each month.

What is the average credit card spending in the UK?

A recent Forbes Advisor poll found that the average person in the UK spends over £300 per month on credit cards.

While many people are able to pay off their credit card bills in full each month, many are not. According to The Money Charity, the total credit card debt in the country is currently around £66.4 billion – a figure that underscores the reliance many have on credit for their day-to-day expenses and larger purchases.

How common is credit card debt in the UK?

According to Forbes, around half of all credit card owners in the UK are worried about their credit card debt and their ability to afford the minimum monthly repayments. For many, these monthly payments have become unaffordable, resulting in credit card debt. The recent cost of living crisis also plays a large role in the increase of consumer credit lending and credit card debt.

What is the average credit card debt in the UK?

The most recent statistics from The Money Charity, from June 2023, show that the average credit card debt in the UK is £2,363 per household. This breaks down to approximately £1,248 per adult.

Around half of all credit card users are ‘revolvers’, meaning they carry an outstanding balance from one month to the next, resulting in interest accruing. Many find themselves in precarious financial positions, struggling to manage their total credit card debt and outstanding balances.

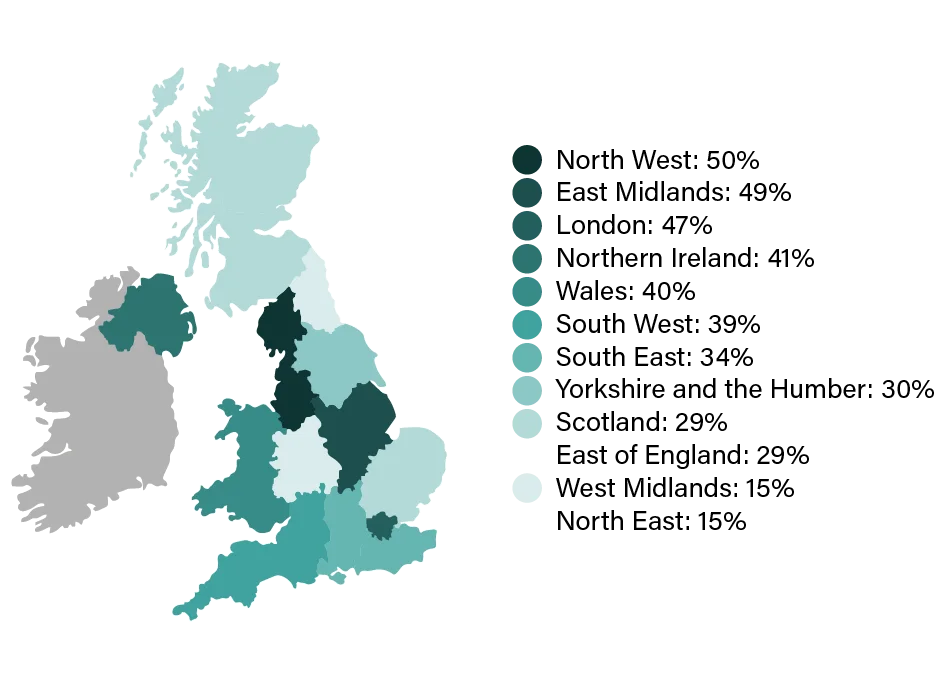

Credit card debt by area

The amount of credit card debt varies across different areas of the UK. A study by Forbes found that the percentage of the UK population in each region in credit card debt is:

North West: 50%

East Midlands: 49%

London: 47%

Northern Ireland: 41%

Wales: 40%

South West: 39%

South East: 34%

Yorkshire and the Humber: 30%

Scotland: 29%

East of England: 29%

West Midlands: 15%

North East: 15%

The North West is the region most affected, with around three-quarters of residents reporting that they are ‘very worried’ about how they can manage credit card debt.

Credit card debt by age group

The study also found that 98% of UK adults aged 35-44 possess between one and four credit cards, and almost half of people take out their first card between the ages of 18 and 24. Among the 18-24 age group, almost 50% own three or more credit cards, and more than half have missed a payment in the last two years.

According to This Is Money, younger adults are twice as likely to use credit cards than those over the age of 55. The cost of living crisis may be contributing to this, with almost 15% of people under 35 now relying on credit cards to help them.

Top tips for managing credit card debt

Managing credit card debt effectively is crucial for your financial well-being. Here are some top tips to help you keep your credit card debt in check:

- Budgeting: Regularly review your finances and set a monthly budget. This will help you understand your spending habits and identify areas where you can cut back.

- Prioritise high-interest debts: If you have multiple credit cards, focus on paying off the one with the highest interest rate first. This will reduce the amount of interest you pay over time.

- Avoid unnecessary expenses: It might be tempting to make impulsive purchases, but it's essential to differentiate between wants and needs. Cutting back on non-essential expenses can free up more money to pay off your debt.

- Set up automatic payments: To ensure you avoid missed payments, set up automatic monthly payments. This can also help improve your credit score.

If you’re struggling with multiple credit card debts, you could also consider a debt management plan (DMP). This consolidates your debts into a single monthly payment, often with reduced interest rates.

The benefits of a debt management plan

A DMP is a structured repayment plan set up by a third-party provider to help individuals manage and repay their debts over a specified period.

Instead of juggling various payments with different interest rates and due dates, you’ll make one affordable payment to the DMP provider, who then distributes the funds to your creditors. Many DMP providers also negotiate with creditors to lower the interest rates and fees on your account.

DMPs can prove helpful for those grappling with multiple non-priority debts, including credit cards. However, it’s important to be aware that you may pay more in total over time if your repayment term is extended on the plan, depending on any interest and fees applicable. Always seek professional advice if you’re considering a potential debt solution.

Looking for consumer credit debt advice? Contact DFH Financial Solutions

While credit card debt might be common, it doesn’t mean you have to live with it forever. With the right guidance and a structured approach, you can regain control of your finances and work towards a debt-free future.

DFH Financial Solutions is here to guide you every step of the way. With a wealth of experience and expertise, we specialise in helping individuals find their way out of debt by creating them a tailored debt management plan that suit their unique circumstances.

If you’re ready to take the first step towards a better financial future, apply online with DFH today.

Get Debt Help